Real Estate News You Need

Love, Amor, Amore - It's all in the air this month. So before we dig in, let us just take a moment to say we wish you lovebirds, love bugs, and even you anti-Valentine's day folks a very happy month of all that mushy stuff and yet another reason to eat chocolate. Okay - back to business. We launched WHAT’S UP SOUTHEAST VALLEY in 2017 with the intention of giving you the real estate news you REALLY need WHEN you need it. Last month we updated you on our steadily declining inventory, especially right here in the Southeast Valley, as well as some of the great new home options that you can get into without having to wait for someone else to take their family pictures off the wall! Interested to see where you can build from scratch, get something move-in ready, or see what other fun stuff we talk about each month? Check out all of our WHAT'S UP SOUTHEAST VALLEY editions and start the month of love off WITH some love (and a little laughter) from your #1 Real Estate Team in the Valley, the Amy Jones Group.

Market Update

So, last month we reported that 2018 was not going to be any less competitive for buyers in general than it was in 2017. We were (in)patiently waiting for the first few weeks of the month to go by when we did our last Facebook Live and were still hopeful that we might see more people putting their homes up for sale as the month progressed. Our buyer's agents shared that while we started the year with 14% fewer listings compared to 2017 across the Valley, our clients in this neck of the woods were experiencing a really, really, really hard time finding what they were looking for.

So, we got to work. We started calling, door knocking and holding open houses for our buyers and what we found was that many people we talked to had NO IDEA that it was a SELLERS MARKET (read: more buyers than houses for sale) and that they could make quite a bit of money on their home. We also found out that lots of buyers thought "waiting it out" was a good idea - so we started having conversations about rising interest rates and continued appreciation which brought us right back to the sell high, buy low bandwagon we've been on for about 18 months.

And Then?

Now that we're just past a week into February, we can see that while listings are still down year over year, there are about 4% more new listings this month than last month which is a great sign for buyers looking to make a move. We know its a tiny grain in the rice bowl, but we're hopeful that the more people we talk to, the more we can help spread the word about what a great time it is to get into the market. Zillow posted a record $1B in revenue for 2017, Opendoor raised $135M to double its market, and real estate investors are banking on 2018 being an exciting year for real estate from Coast to Coast - all while the local Southeast Valley market is doubling down on new developments in Downtown Chandler, Gilbert & Queen Creek, new home construction from Tempe to San Tan, and the City of Mesa is creating an Innovation District anchored by ASU.

Intrigued?

We've had more than a dozen clients take advantage of the equity in their home to start their investment portfolios since the New Year, put their home on the market after waiting through the holidays when they knew that they needed a little more space, and renters who were fed up with constant increases take the jump into home ownership where they'll realize the gain in property values from Day 1. The million dollar question is just how long will it be? Some are saying 12 months, others 24 months, but what we know for sure is that the inventory shortage cannot be cured overnight and while that may provide some challenges (see below for our local expert's take on this!) - it is definitely an incredible opportunity for both sides of the closing table. BTW - If you are one of those renters reading through this and your blood pressure is rising just thinking about the rate increase, peep this and email us if you want in:

But, I Already Have a House!

With the strong appreciation we have seen in our housing market over the last 5 years and are projected to continue to see through 2018, 75% of you have at least 20% equity in your homes and are now able to sell your current home and buy your next home with a sizable down payment. Yay YOU! Most people assume, however, that in order to unlock that equity to put it down on your next home that you have to sell first, and THEN buy your next home. But HOW does that work? Here are the TOP THREE concerns our clients are telling us that they see with that plan and the solution that our local expert, Amber Kovarik with Guild Mortgage, says can avoid ALL OF THEM -

Common Frustration #1

You have to try and time the sale of your home with the purchase of your next one in what we call a simultaneously close meaning that we can orchestrate moving your family out and in on the same day. While we do everything we can to pull this off (and have a great track record of doing so), this can prove challenging and may cause you to end up crashing on someone’s couch for a bit, living with the parents (or possibly worse - the in-laws!) or in a short term rental situation if the stars and moon do not align. With the current housing demand we are experiencing, it may be much easier to sell your home than to find the next one so being able to get a jump start on that could be a life saver.

Common Frustration #2

Once you find that dream home where you want to create your future family memories, you will likely have to write an offer contingent upon you selling your current place. Depending on what price point you are buying in there is a strong likelihood in this market you will be up against competing offers. A contingency in your offer is not ideal and does not help your case although it is becoming more and more common and the Amy Jones Group is well versed on how to negotiate with one. If you think about it from the home sellers point of view, when you submit an offer contingent upon you selling first, the seller has to decide if they are willing to risk the sale of their home on when and if you'll sell your home. If the sellers have another offer that is not contingent upon a sale they might be more likely to take that offer because there is less perceived risk to them.

Common Frustration #3

The inconvenience of having to keep your current home show ready at ALL times - and maybe this should have been #1 on the list. At a moment’s notice your potential buyer may want to drop in and see the house and as a team full of women with kids, partners and fur children know, keeping your home model perfect at all times is quite a feat. And then there's leaving for showings, not eating fish for a month, delaying naptime, need we go on? The Amy Jones Group will help make the showing process as smooth as possible but if you can buy first before you sell, even better.

So, What's the Solution?

It is called a recast and this opportunity is unique to lenders that service their own loans. What this means to you is that we've got a partner who can qualify you with both mortgages (the current home and the new one you are purchasing), buy your new home with a minimum down payment, which in most cases is 5% (using your own funds, 401K funds or a gift from a family member) and then YOU decide when you are ready to list your home for sale. It could be while you are closing on your new home, right after you closed or maybe you decided to do some improvements to the new place, so you put your home up for sale once the work is all done.

The beauty of this option is that YOU are in control of when your home goes on the market and the Amy Jones Group will be right there again to help you with the final piece. Once it sells and you have the proceeds in your bank account, you can take whatever portion you want and pay down the new loan by calling Guild Mortgage, they'll re-amortize (read: recalculate your mortgage payment based off the new lower loan amount). So, if you only put down 5% initially but now after the sale you put down enough to get you below 80% loan to value, we will initiate the process of getting your mortgage insurance removed. The best part? In almost all cases this process cost you nothing AND you can do the recast up to once a year on your loan. Does it get much better? Let's find out together.

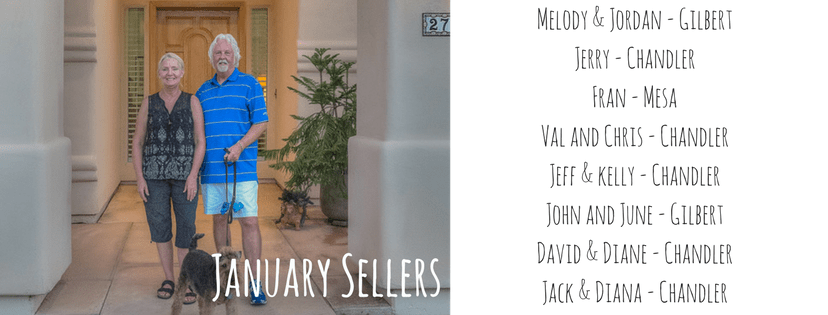

January Closing Shout Outs

We couldn't do any of this or have this much fun doing it, if it wasn't for you! Congratulations, Salute, and Mazal Tov to these buyers and sellers who made big moves in January!

Hometown Happenings

Looking for something fun to do? So are we! We live, work and play in the Southeast Valley and this month we’ve got our eye on these upcoming events:

Queen Creek Olive Mill Spring Art Market

Gilbert Bluegrass Jam at the Gilbert Historical Society

Hello Kitty Cafe Truck at San Tan Village

Hot Topics

We're always keeping our ear to the ground when it comes to local news impacting our Southeast Valley 'hoods. Here are a few that caught our attention:

New Gilbert Park - 272 Acres of Amazing!

3D Tours Launch in Phoenix - Have You Seen It?

Want to Own an Investment Property? Gilbert is the Place.

Are Higher Loan Limits Helping? Maybe.

A Password Required Speakeasy? Yes, Please.

Great Wolf Lodge Indoor Water Park? Holy Moly.

$160M Renovation in the Works and It Includes Hockey

ReNEWable Homes Over 30 Years - A Huge Savings

Have somewhere you are excited to be next month, a story we just HAVE to read, or an idea for an upcoming newsletter topic? Reach out to us at [email protected] - we'd love to hear from you!